DEP - DECENTRALIZED EQUITABLE PROPERTIES. Making REAL ESTATE INVESTMENT ACCESSIBLE TO EVERBODY

Why We Created the DEP Coin Security Token Offering

DEP Coin Security Tokens were created to allow investors to buy tokenized shares in DEP COIN INTERNATIONAL INC, which owns properties as a holding company. This allows for high liquidity and reselling of these assets, real estate ownership truly made available to everybody, access to investment funds without having to seek it from big banks and institutional lenders, as well as a token backed by real asset value of properties, distribution of dividends, and reduction of risk with the ability of diversifying real estate investments to a greater degree. These are legally binding and enforceable tokens (which are on the blockchain permanently, and not just a deed), which is a big plus for investors. This could also be referred to as a more democratic approach to investment.

Only 7% of global real estate investment is accessible by investors while 80% want to invest ,

by tokenizing we allow for access to international investment. Aside from giving wide access to a larger market as well as lower cost of entry to buy real estate, tokenization of real estate allows for less tedious paperwork, intermediaries, and processes that limit real estate from reaching its full potential. A widened investment pool to secure funds from can therefore increase the token value. Securitization of these assets is done through an SPV (Special Purpose Vehicle), we have properly structured assets and liabilities of the developer are separate from that of the SPV, for accounting, tax, and bankruptcy purposes, as this allows for the token to stand on its own merit as an investment.

Smart contracts allow for the token to exist on the blockchain and enforce agreements between users without human intervention, and so it cannot be manipulated due to being connected to the blockchain. We ensure token holders receive dividends, as we let the power of appreciation drive up token price.

In closing, real estate is the biggest single asset class, worth $228 trillion, where tokenization can provide the most value to its holders.

STEP 1

Request to join our whitelist If you haven’t already

If you’ve spoken with Investor Relations and have

been set up to invest with your representative, you should already be on the whitelist *

Head over to https://f5iverealestate.com/#whitelist/ enter your email and details or send us an email at investors@depcoin.io , alternatively you can speak to your representative and we can do it for you!

STEP 2

SEND E -TRANSFER TO OUR ACCOUNT OR SEND ETH TO OUR WALLET VIA METAMASK

Simply E-transfer funds to ….. through your bank after being whitelisted.

Alternatively for those who know how to use wallets and navigate the crypto environment, after being whitelisted , head over to https://metamask.io/download and click download based on whatever browser/device you are using. After which you will see it installed on your extensions in Chrome or within your apps on your smartphone.

Keep your Secret Keyphrase safe (do not lose it!) and make sure you always remember your password! After which click on buy and send the Eth purhcased to this address: 0x89B84DA99000D1143245241fb5Acf78f2bc26DBd

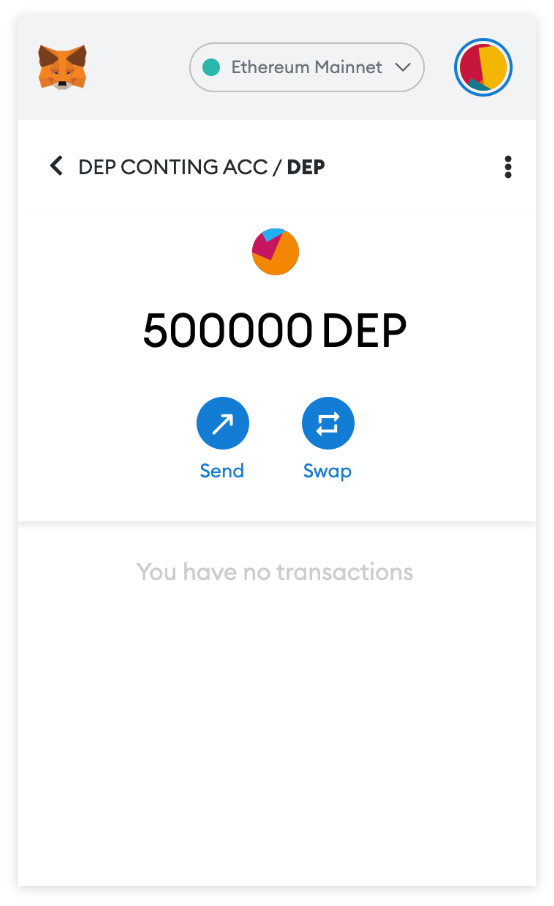

STEP 3

WAIT 3-5 Business days FOR YOUR

WALLET + TOKENS AND SHARE CERTIFICATES

Within a couple business days your representative will be sending you your wallet, and you should see DEP Coin added to your account under assets. Congratulations you will also receive a shareholder letter and a share certificate and own property in Toronto! These shares can be liquidated shortly after our STO within 6-8 months when we list on a decentralized exchange and are projected to generate high returns and quick liquidity in a public secondary market.

STEP 4

Collect your dividends and Watch your tokens appreciate

Collect dividends from your token as DAI or Eth, and let the power of appreciation, real estate, and blockchain technology drive the value of your token.

DEP Coin will be expanding it’s portfolio steadily and developing technology that’s cohesive with real estate through the blockchain,

In the coming year we are going to build a digital platform where ordinary people can own real estate and fractionalize their ownership in property and cash-flowing assets.